The Trumps' World Liberty Financial project has frozen WLFI tokens in wallet addresses belonging to Justin Sun that contain ~$100 million (on paper) in unlocked WLFI. Sun is a major backer of the project, which the Trumps say they founded to stop "debanking".

The freeze apparently came after Sun transferred around ~$9M of his holdings to Binance.

The World Liberty team has been desperately trying to prevent the WLFI price from sinking, including by burning tokens to boost the price. They may be concerned that whales like Sun could further depress the token price by cashing out.

Sun is claiming he was merely testing exchange deposits (?) and not buying or selling. He seems to be responding to suggestions that he was the one tanking the token price, though it's not clear if this blame is coming from WLF directly.

Prior to this, Justin Sun's HTX exchange was running a "high-yield event", offering people 20% APY if they deposited their WLFI tokens on his exchange.

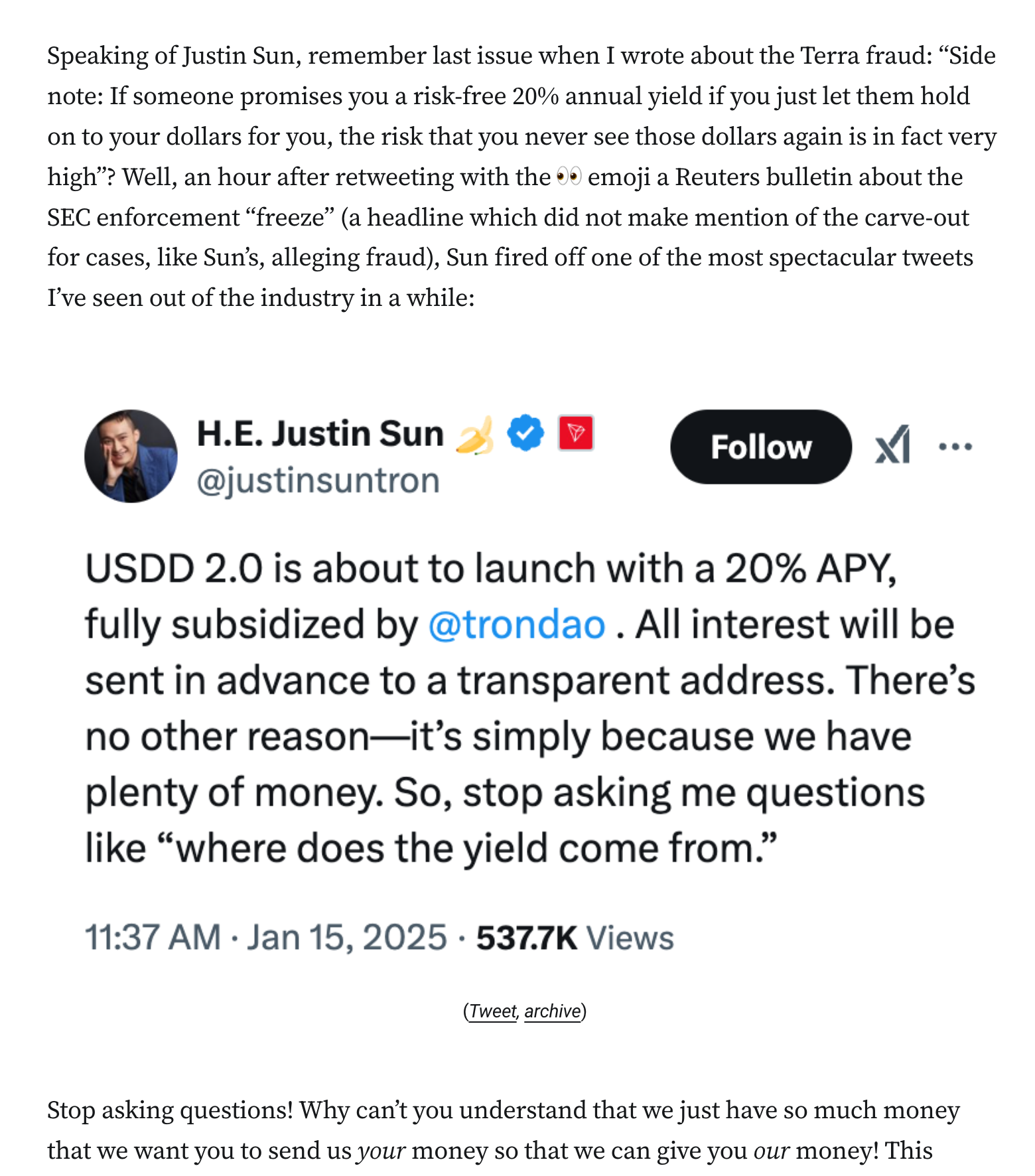

Sun has in the past snapped at people questioning his high-yield products, admonishing them to "stop asking me questions like 'where does the yield come from'" and claiming it's fully subsidized by the company. As I wrote then: