The judge has declined Justin Sun's motion for a temporary restraining order and preliminary injunction against Bloomberg, finding that Sun failed to establish that his case is likely to succeed on the merits or that he will suffer irreparable harm without preliminary relief.

Thoughts tagged "Sun v. Bloomberg"

Short thoughts, notes, links, and musings by Molly White. RSS

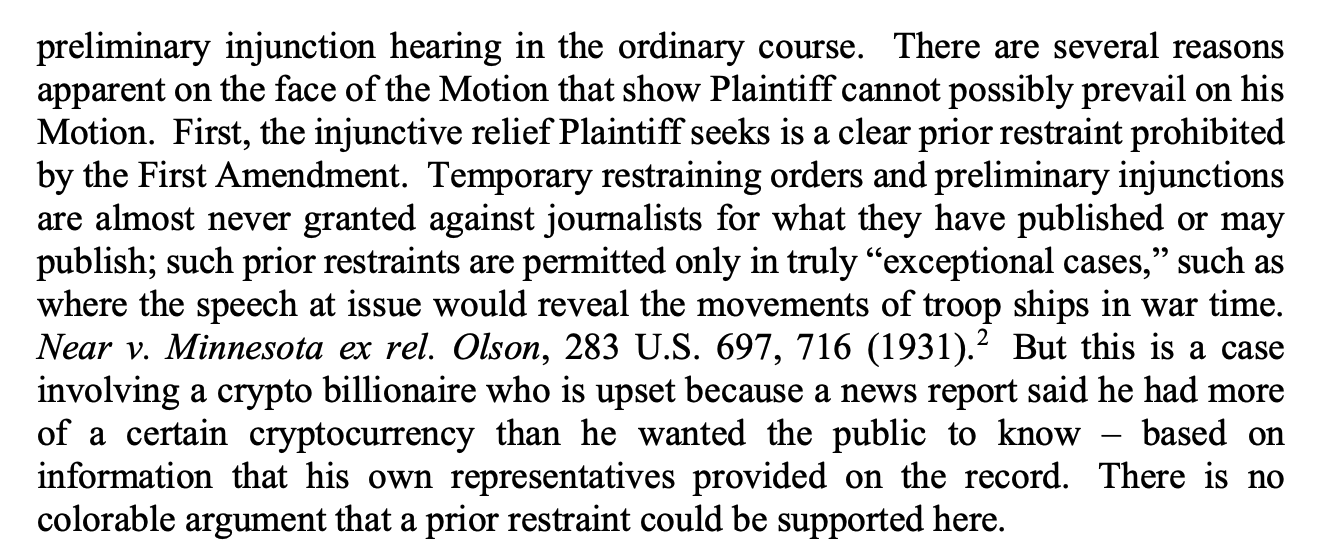

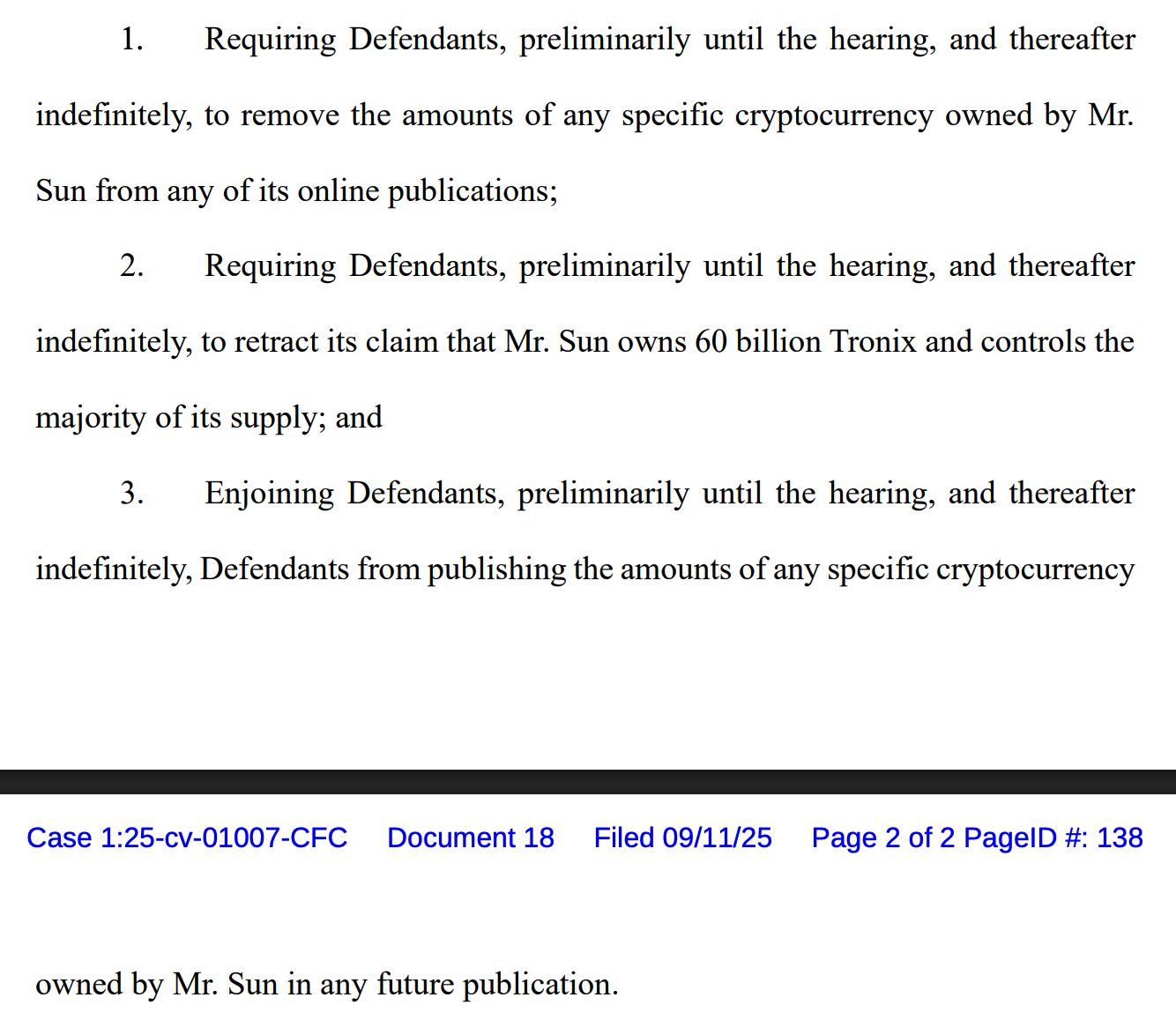

Bloomberg has filed their opposition to Justin Sun’s renewed motion for emergency relief, arguing they never promised not to publish the information he and his team provided to them. They also argue that his demands they remove the article about him and prevent them from publishing a second one would violate the First Amendment.

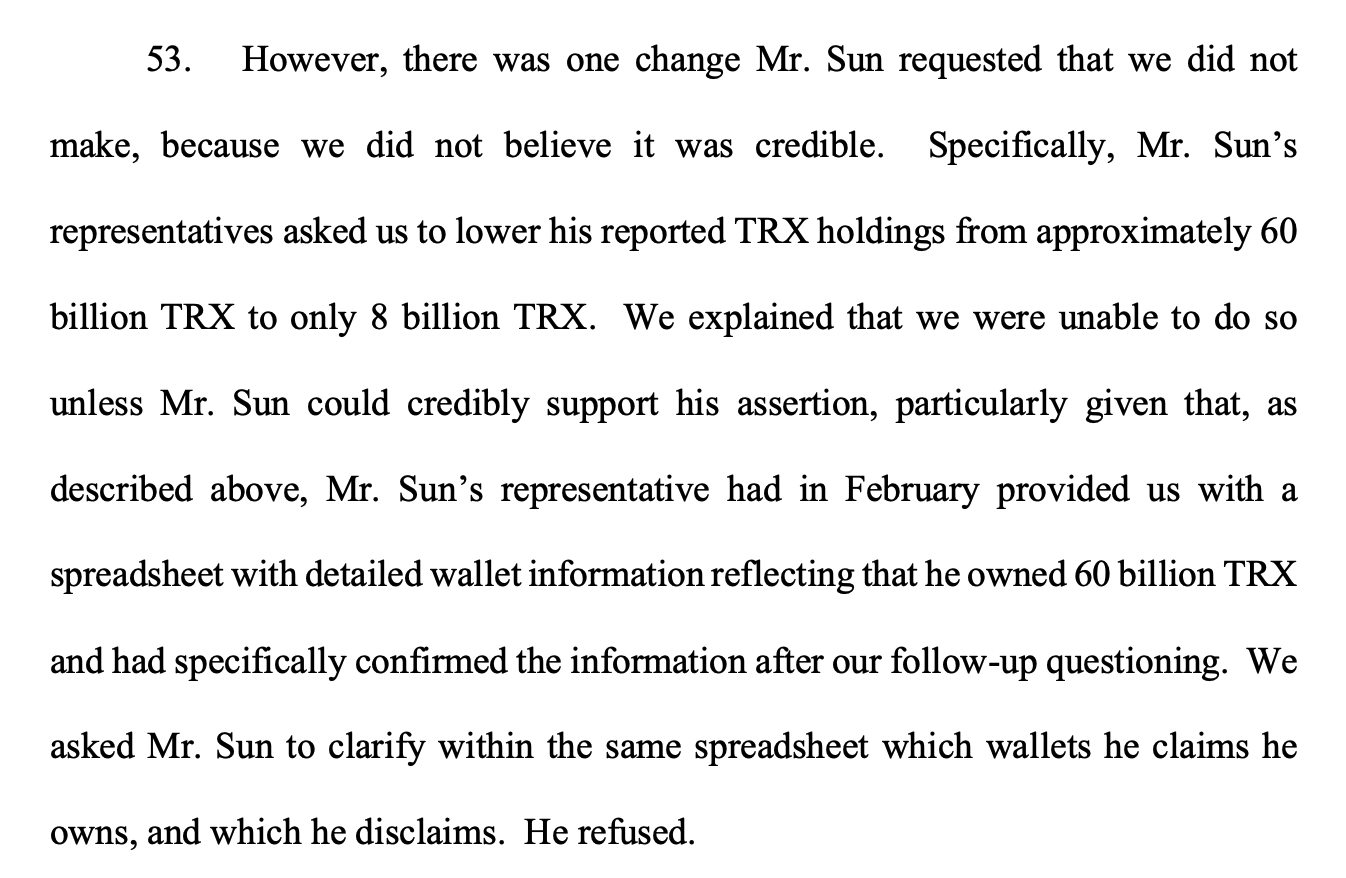

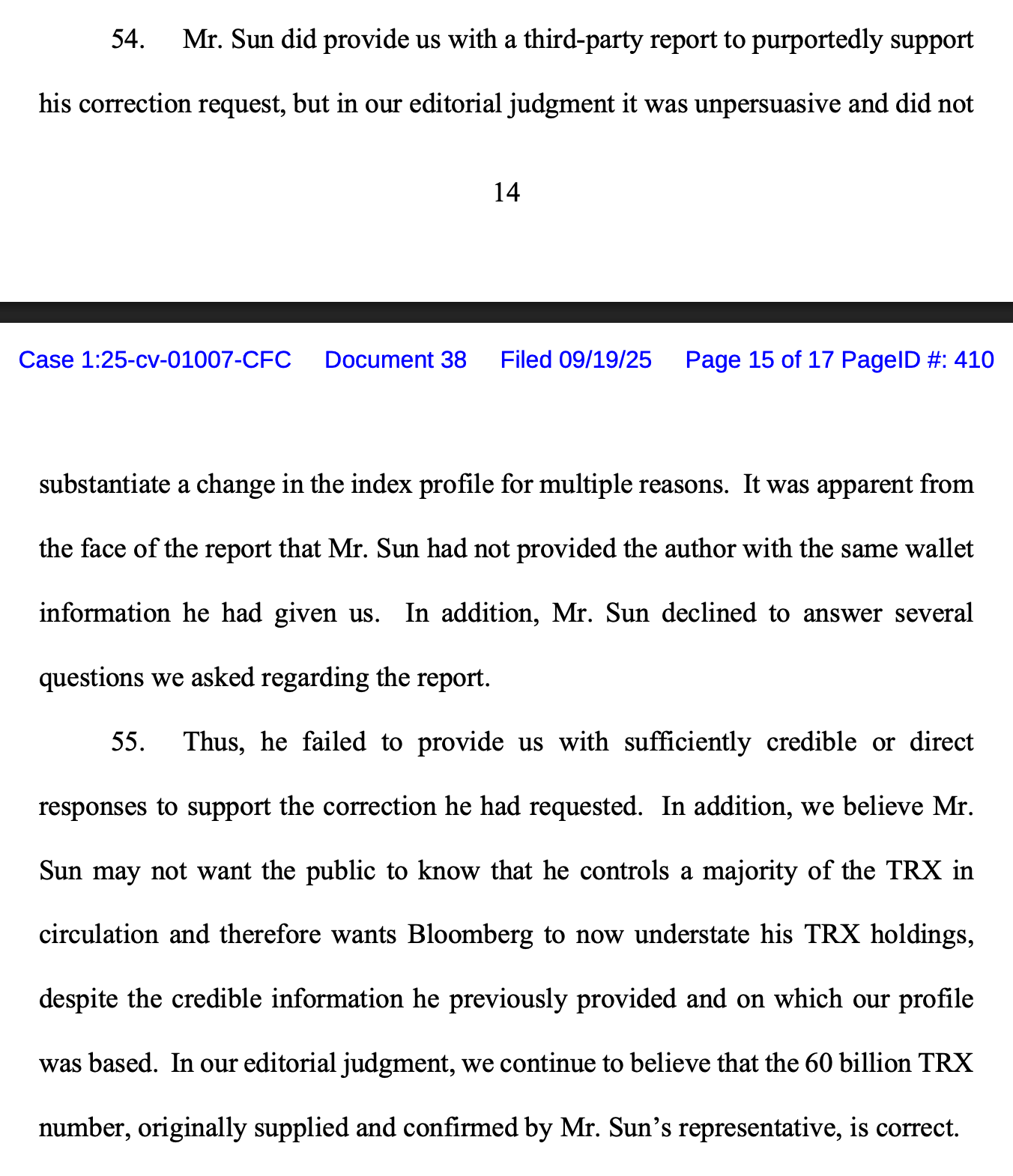

After publication, Sun asked Bloomberg to reduce his supposed ownership of TRX from 60 billion (~63% of circulating supply) to only 8 billion. Bloomberg refused. “[W]e believe Mr. Sun may not want the public to know that he controls a majority of the TRX in circulation”

Also: I seem to have become an exhibit

(Answering brief, exhibit 5 to Hentoff declaration)

Justin Sun has hired Baker & Hostetler lawyer Teresa Goody Guillén to represent him in his lawsuit against Bloomberg. Goody Guillén has previously represented the Trump family’s World Liberty Financial, and she has lobbied for a presidential pardon for Binance’s Changpeng Zhao.

From an August issue of my newsletter:

Bloomberg has responded to Justin Sun’s renewed motion for a temporary restraining order.

“This is a case involving a crypto billionaire who is upset because a news report said he had more of a certain cryptocurrency than he wanted the public to know — based on information that his own representatives provided on the record.”

Crypto billionaire Justin Sun’s renewed motion for a temporary restraining order in his lawsuit against Bloomberg seems to confirm my view that the lawsuit was sparked by the disclosure that he controls 63% of the supply of TRX.

Sun and Bloomberg had been “engaged in discussions that may moot the emergency relief”, but it sounds like Sun wanted more than they were willing to agree to.

Justin Sun v. Bloomberg

Justin Sun has just filed a lawsuit against Bloomberg, claiming they plan to “recklessly and improperly disclos[e] his highly confidential, sensitive, private, and proprietary financial information,” which he gave to them while they were verifying his assets for inclusion in the Bloomberg “Billionaires Index”.

Sun claims this will cause him “significant and irreparable harm—both financially and physically.” He says they plan to use the information in an article unrelated to the Billionaires Index. He also claims they plan to publish “granular details about his cryptocurrency assets, including a breakdown of his cryptocurrency holdings,” in the Billionaires Index, and that he wouldn’t have agreed to share the information had he known.

Sun sent a cease and desist to Bloomberg, and was informed they still intend to publish. He now seeks an injunction against the company.

The “agreement” Justin Sun says should prevent Bloomberg from publishing the amounts and types of crypto assets he holds seems extremely shaky to me (caveat: I’m not a lawyer, some images are missing).

It looks like Justin Sun and his team sent the information he now claims is confidential on or around February 28.

A month later, on March 27, Justin Sun posted terms including: “The data is solely for verification and may not be used for any other purpose (including reporting) ... Bloomberg must also agree to use the data strictly in accordance with our requirements — for example, to provide only a general assessment or overall valuation based on the data, without making any specific references or detailed reporting on the figures.”

Bloomberg’s Tom Maloney: “Nobody at Bloomberg agreed to the terms sent by Justin, weeks after the data was shared with us.”

Bloomberg says they will oppose a temporary restraining order, but also that a TRO is moot because Bloomberg already published.

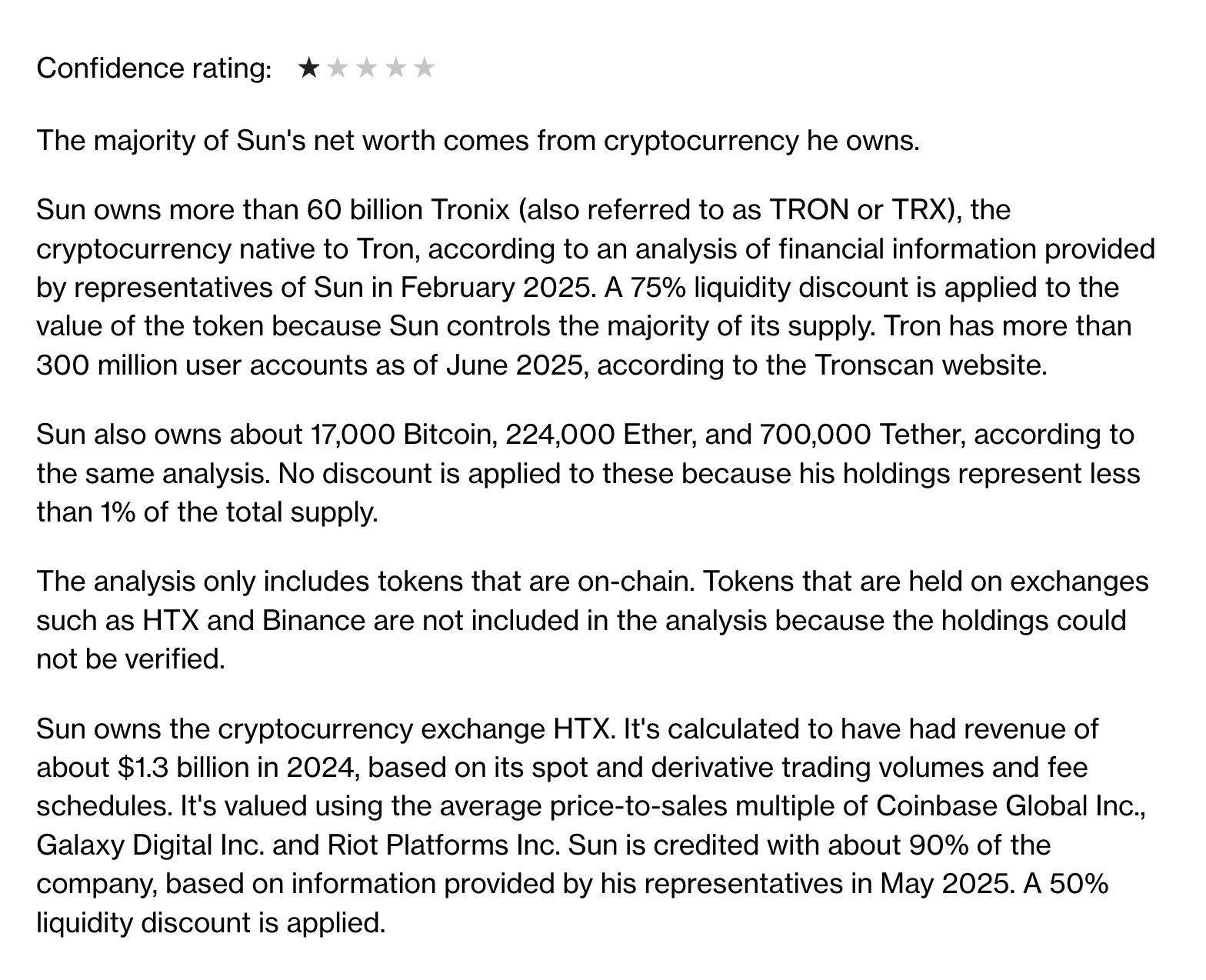

It seems Sun is objecting to VERY rough estimates of his crypto holdings (~60 billion TRX, heavily discounted; 17k BTC; 224K ETH; 700K Tether).

My guess is that his fury here is at the revelation that he controls 60 billion TRX (63% of the total supply, and it’s not clear to what extent they’re counting TRX held by companies he owns). It’s always been known he owns a lot, but estimates I’ve seen are lower than that.

The other explanations that I’ve brainstormed don’t really make sense. The estimates likely aren’t specific enough to be identifying, as he claims. And I doubt it’s an ego thing at having his net worth shown to be lower than he wants — Bloomberg puts him at $12.4B, higher than Forbes’ $8.5B. (Though maybe he wants them to say his 60B TRX are worth $21.6B, idk)

![Former Binance CEO Changpeng Zhao is still hard at work trying to secure a pardon for his 2023 money laundering conviction [I79, 83]. Zhao has personally spent $30,000 in the last few months on lobbying the president for “executive relief”, hiring BakerHostetler partner Teresa Goody Guillén (a former SEC lawyer from 2009–2011).31 Since March 24, Binance has also spent another $190,000 on Goody Guillén’s and other BakerHostetler lobbyists’ services to lobby Congress, the SEC, and the CFTC on “financial services policy issues relating to digital assets and cryptocurrency”.32 Goody Guillén simultaneously represents the Trump family’s World Liberty Financial project; she wrote the brief May retort from the company in response to Senator Blumenthal’s questions about Trump’s conflicts of interest [I83, 84].33](https://storage.mollywhite.net/micro/dfbc9c62fdc2132c3181_Screenshot-2025-09-12-at-3.13.39---PM.png)