The president took an oath to serve the American people. Instead, he's focused his second term on enriching himself and his family.

Activity tagged "crypto"

Issue 100 – Freedom of all kinds is worth fighting for

House Oversight Democrats have published a Web3 is Going Great-style “Trump Family Digital Grift” counter.

This goes with their recent staff report, “Professionalized Corruption: How Donald Trump is abusing power and accepting digital kickbacks from foreign and criminal interests to cash in on the presidency like never before”.

The report cites some of my writing on Trump’s USD1 stablecoin.

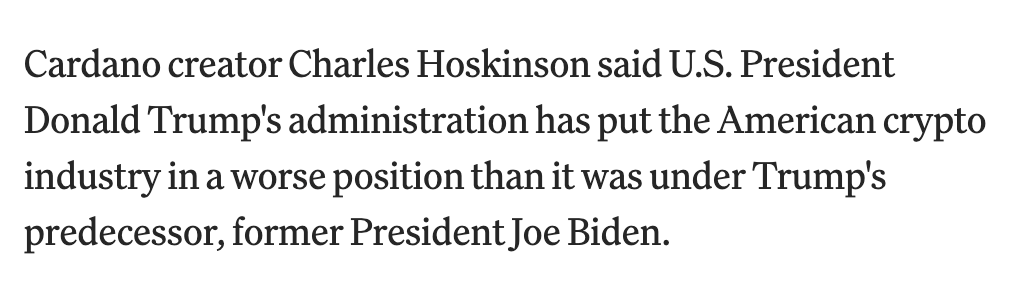

![Cardano founder Charles Hoskinson has also clearly been trying to woo Trump, claiming very shortly after the election that he was “going to be spending quite a bit of time working with lawmakers in Washington DC and quite a bit of time with members of the administration to help foster and facilitate with other key leaders in industry the crypto policy”.6 While he has continued to boast vaguely about meetings with various influential figures, winkingly describing a “VIP dinner” where “diet coke will certainly be on [the menu]”, there’s been little outside confirmation that he’s had much access to the Trump administration.](https://storage.mollywhite.net/micro/ebf999a8f79f352f9173_Screenshot-2026-01-13-at-10.35.28---PM.png)